Rent Vs Buy

Your Future Home Awaits - Let's Find It Together

Homeownership Economics:

Renting vs. Buying

Are you at a crossroads deciding whether to rent or buy your next home? You're not alone. It's a big decision, and we're here to help you navigate through it. With our expertise and personalized approach, Gustavo Lopez and Ed Diaz are committed to finding the best path for you.

When considering your housing options, it's crucial to understand both the immediate and future financial implications. Our goal is to empower you with knowledge to make the best choice for your lifestyle and economic circumstances.

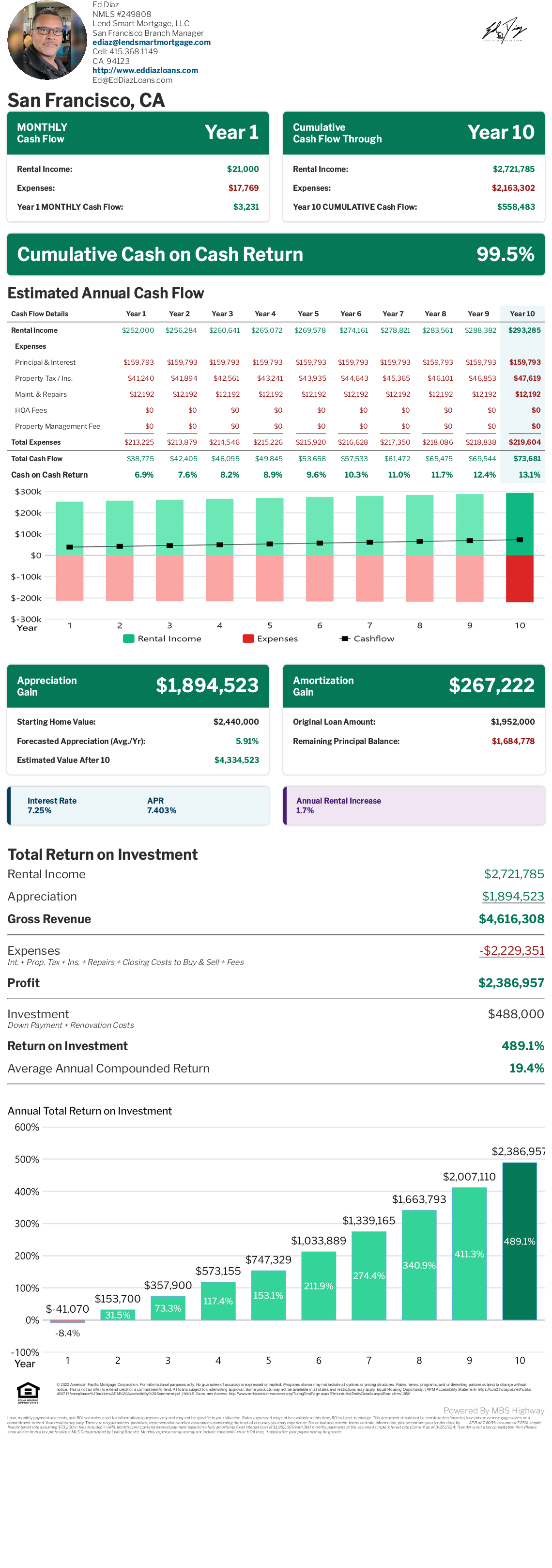

Gustavo Lopez and Ed Diaz, present a nuanced comparison between renting and buying in the current San Francisco market. With insights into appreciation rates, mortgage amortization, and the cash flow differences over a 10-year span, we provide you with the tools to assess how buying can be a valuable investment versus the cost of renting.

While renting can provide flexibility and lower upfront costs, homeownership may offer the opportunity to build equity and benefit from property appreciation in the long run. We delve into these aspects, giving you a clearer picture of how each option could impact your finances over time.

For a personalized analysis and to explore which path aligns with best with your lifestyle goals, connect with Gustavo and Ed. They're ready to guide you through the process so that you can make a financially savvy decision that fits your unique situation.

For this scenario we’ve estimated the numbers for demonstration purposes. Each property has its own unique variables such as current potential rents, and expenses. Interest rates are also variables subject to the current market. Talk with us, and we’ll show you how we’ve done the math and identify potential properties that will work for you.

Purchase Price: $2,440,000

Down Payment: $488,000

Loan: $1,952,000

Rental Income: $168,000 (2 of the 3 units, Year 1, not including future increases)

PITI & Maintenance: $213,225

Cash Flow: -$45,225 (or $3769/Mo. This is your monthly cost to own your $7000/Mo rental property)

Added bonuses, all of which potentially reduce your monthly costs:

- Depreciation and Schedule E Tax Deductions

- Annual Rent Increases

- Anticipated reduced interest rates

- Estimated Appreciation of

$1,894,523 Over 10 years (Almost 4 times greater than your original investment)

This worksheet provides the detailed figures for the buying scenario, showcasing the potential rental income and net profit from buying the triplex and renting out all three units over a ten-year period.

*Please note, our materials are intended for educational purposes only and are not to be taken as financial or legal advice. We encourage consulting with a professional for personalized guidance.

CA DRE 01254853